The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Energy star entry door tax credit.

This wasn t a particularly generous tax credit.

For more information about this credit or those from previous years visit www irs gov and see the instructions for form 5695 residential energy credits.

Federal income tax credits and other incentives for energy efficiency.

25c in previous tax years is no longer eligible for this tax credit.

10 of the cost up to 500 but windows are capped at 200.

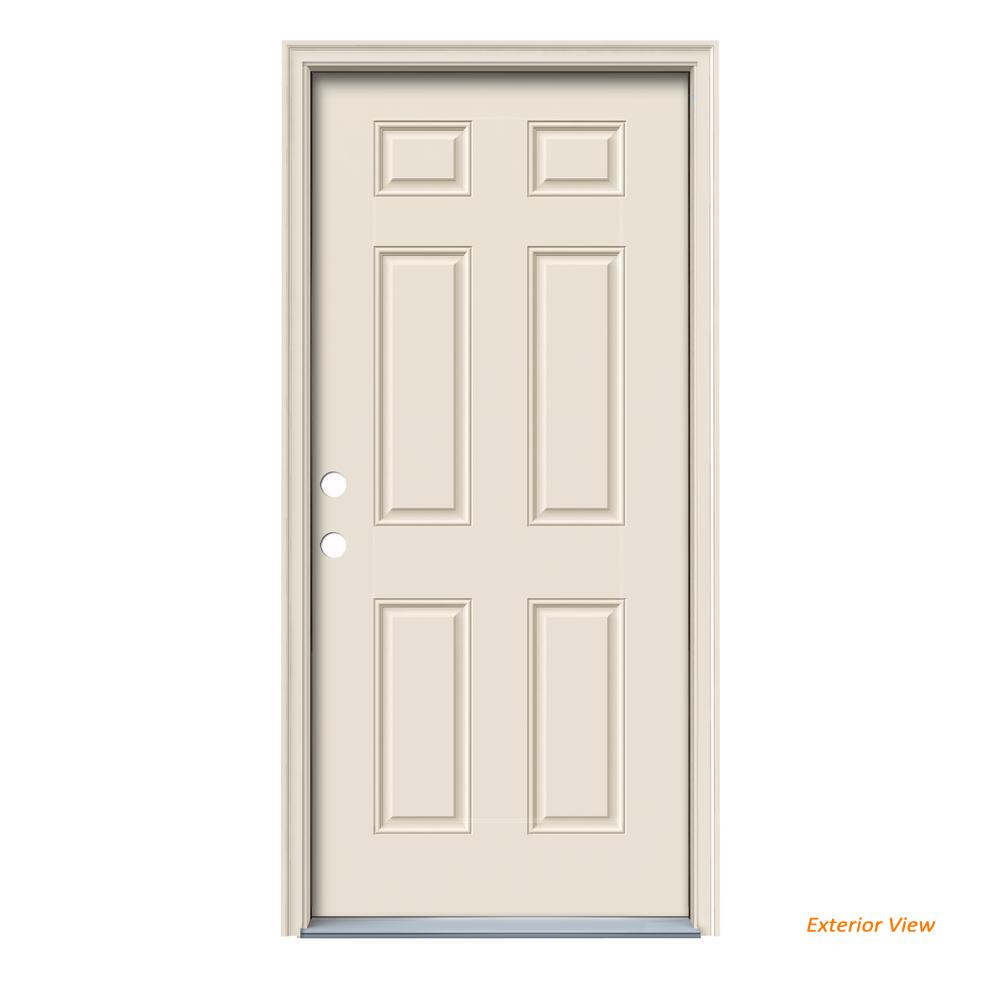

Not including installation requirements must be energy star certified.

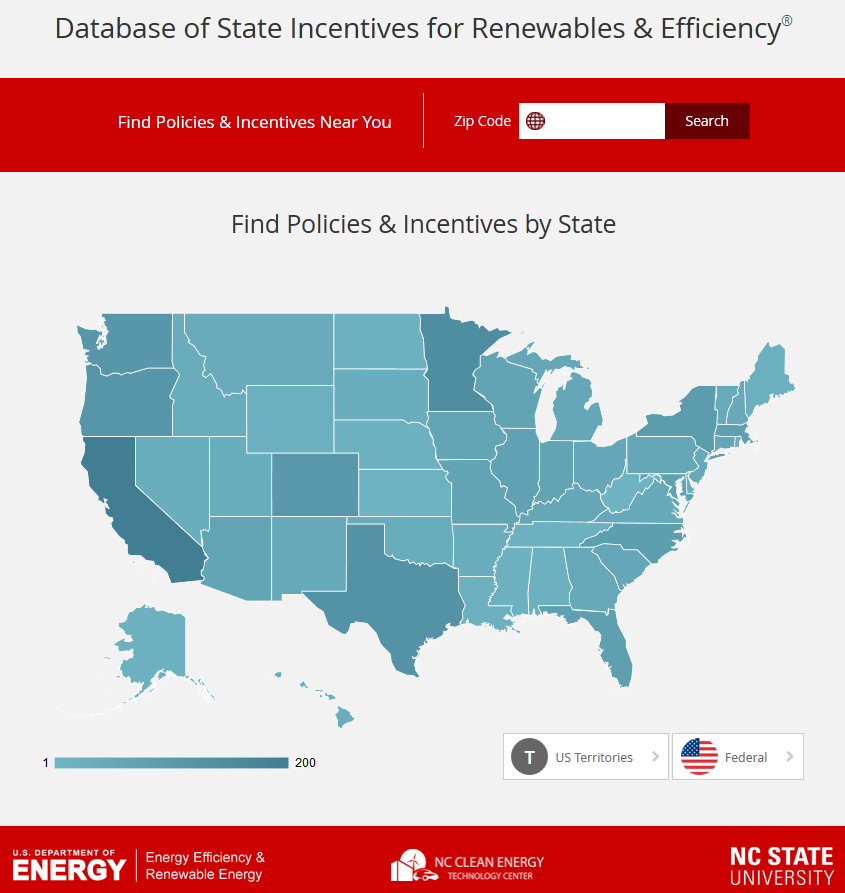

While large national programs providing federal income tax credits for exterior doors that qualify under the energy star program expired in 2010 and 2011 some states counties and localities offer other tax credits.

Non business energy property credit.

A homeowner who has already claimed the maximum applicable tax credits permitted under 26 u s c.

Claim federal tax credits for installing energy star certified windows.

Windows doors and skylights that earn the energy star save energy improve comfort and help protect the environment.

If your house is older than 1978 be sure to look for contractors who are certified to handle lead paint.

Here are some key facts to know about home energy tax credits.

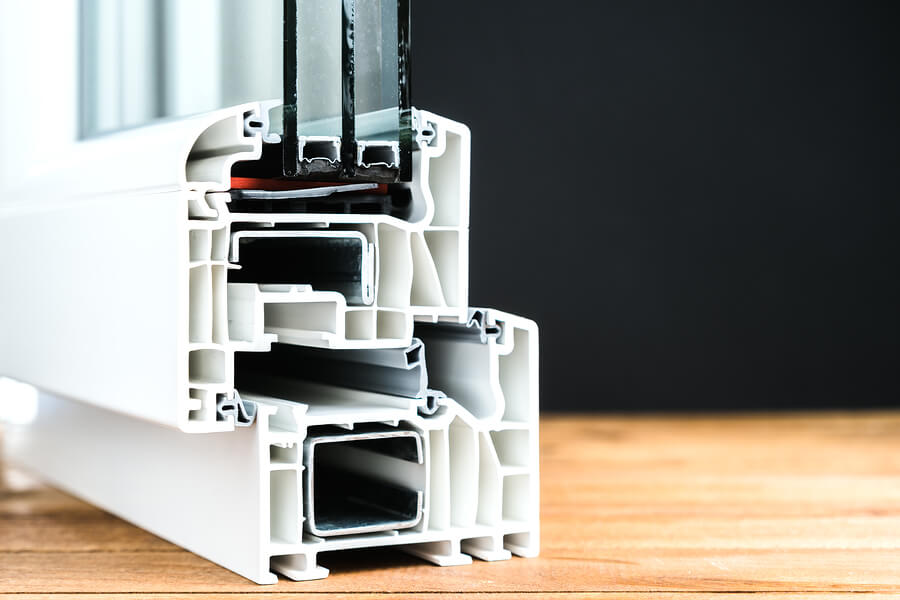

Energy star certified windows doors and skylights may cost more than non certified products but the labor involved should be comparable for both.

Learn more about energy star find more information at www energystar gov or call 888 star yes 888 782 7937.

31 2020 you may be eligible to claim a one time tax credit of up to 500 on the purchase price of a new energy star qualified exterior therma tru door.

You could deduct 100 of energy related property costs but this portion of the credit had a maximum lifetime limit of 500 you couldn t claim 500 per year.

Part of this credit is worth 10 percent of the cost of certain qualified energy saving items added to a taxpayer s main home last year.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

You do not have to replace all the windows doors skylights in your home to.

Look for energy star when purchasing products.

Federal and state legislatures also consider new tax credit and tax rebate programs each year.

Qualified improvements include adding insulation energy efficient exterior windows and doors and certain.

Purchases from 2018 and 2019 may also qualify.